Merchant cash advances offers small business owners with an easy application process for fast funding. Business owners receive funds as a lump sum from a merchant cash advance provider and repay the advance from future sales, often on a daily basis.

Merchant Cash AdvanceDetails

FUNDING AMOUNTS

$2,500 – $500,000+

EFFECTIVE RATES

30 – 350%+

REPAYMENT TERMS

3 – 36 Months

FUNDING TIME

1 – 3 Days

Pros

- Fast approval and funding

- May offer flexible repayment terms

- Good credit scores not required

- Wide range for use of funds

- No collateral required

Cons

- Often expensive

- Daily payments can hurt cash flow

- Doesn’t help build business credit

- May lock-in merchant processor

- Must accept debit and credit cards

What is a Merchant Cash Advance (MCA)?

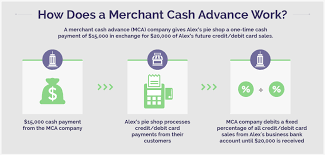

A merchant cash advance is not technically a business loan but instead offers an advance against future sales, based on past debit and credit card sales.

The funding provider gets paid back by automatically taking a portion of future credit card sales, usually each business day. Qualified business owners can usually get approved in a day or two, with very little paperwork.

Merchant cash advances provide small businesses with an alternative to other types of small business loans that may be harder to get, such business lines of credit or traditional bank loans. Business owners receive funds as a lump sum upfront from a merchant cash advance provider and repay the advance from future sales. An MCA can be a funding option for businesses that have high credit card sales volume, need funding quickly, and may not qualify for other small business loans.

But you’ll likely pay for this convenience with costs that are higher than traditional small business loans. Here we’ll explain what you need to know if you’re considering this small business financing option

Where to Get a Merchant Cash Advance

A number of companies offering merchant cash advances. Here’s are a couple of popular options:

Credibly

Credibly offers $5,000 – $400,000 to small businesses with at least six months in operation, $15,000 in monthly revenue and a minimum 500 credit score (with a soft credit pull). If approved, funding is fast: As quickly as 1 business day Repayment terms: Daily debits from your bank account for 3 to 18 months.