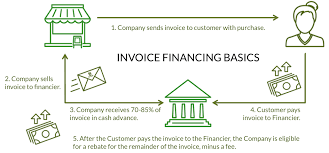

Invoice financing provides businesses with working capital to improve cash flow, pay employees and suppliers, and reinvest in operations and growth by providing short-term financing secured by outstanding invoices.

Invoice Financing Details

LOAN AMOUNTS

Up to 100% of invoice value

INTEREST RATES

15% – 35%+ effective APR

REPAYMENT TERMS

Up to 4 months

TURNAROUND TIME

As Little A 1 business days to weeks

Pros

- Low APRs available

- Predictable payments

- Can help build business credit

- Equipment serves as collateral

Cons

- Can require high down payment

- Requires strong credit for good terms

- Financed equipment can become outdated while payments continue

Get to Know Invoice Financing